What’s Up with Real Estate?

National news and local views for the week ending Friday, November 17, 2023

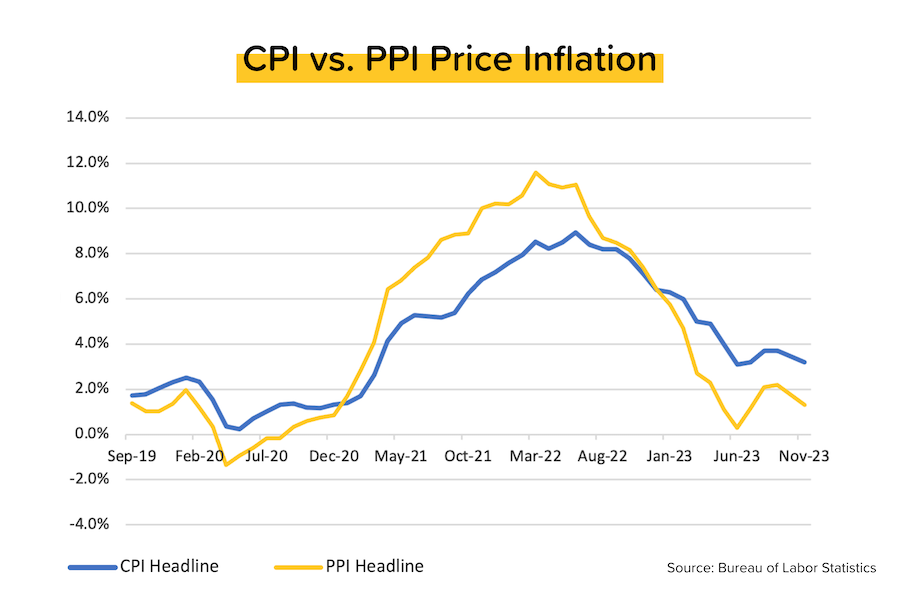

Inflation elation

Both the CPI (Consumer Price Index = inflation for you and me) and the PPI (Producer Price Index = inflation for companies) trended downward more than expected in October. “Headline” CPI dropped to +3.2% YoY (from +3.7% YoY in September) and “core” CPI eased to +4.0% YoY (from +4.1% YoY previously.) This significantly increased the odds that the Fed is done hiking rates, even if they won’t say it.

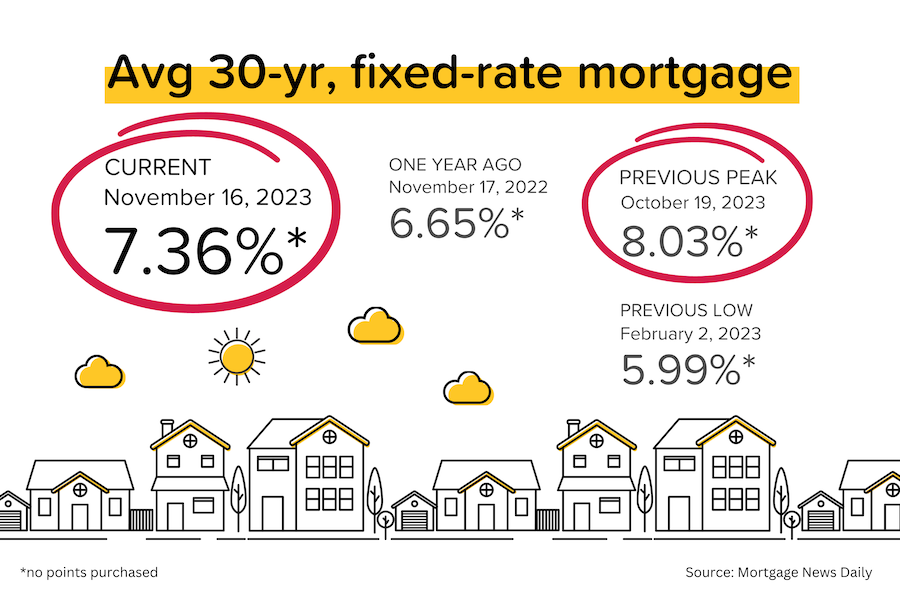

Mortgage rates plunge

Lower inflation = higher bond prices = lower bond yields (and mortgage rates). A month ago, 10-year US treasury bond yields were flirting with 5%. Now they’re below 4.5%. Over the same time period, average 30-year mortgage rates have moved from 8.03% to 7.36%. The market is no longer believing the Fed’s “higher for longer” rhetoric, and is instead expecting multiple rate CUTS to start as early as March 2024.

Did you know?

The typical age of first-time home buyers is 35. The typical age of home sellers is 60. Even with high rates & home prices, first-time buyers were still 32% of the market. The typical home purchased was 1,860 square feet and 3BR/2BA. 19% of recent buyers were single females, vs. 10% for single men. 89% of sellers used a real estate agent to sell their home. 90% of buyers would use their agent again.